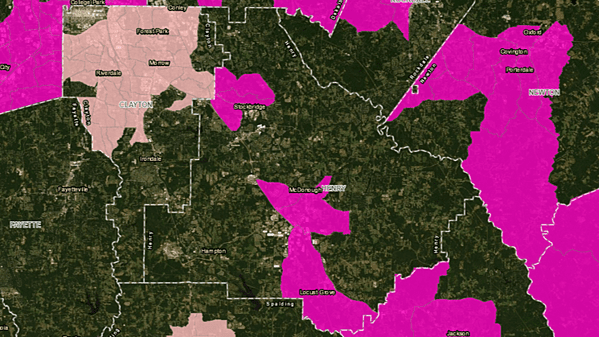

LESS DEVELOPED CENSUS TRACTS – 2020 UPDATE

The Less-Developed Census Tract (LDCT) program, implemented by the Georgia Department of Community Affairs (DCA), is designed to induce businesses to create jobs in certain areas. Each year DCA ranks the state’s census tracts. The 2020 census tract ranking was released on January 15, 2020. While Henry County is a Tier 3 county, 6 areas were designated as less developed census tracts making them eligible for tax credit benefits similar to Tier 1 counties.

| 701.06 | 701.13 | 703.11 |

| 701.11 | 703.04 | 704.04 |

Henry County also experienced changes in our Less Developed Census Tract rankings this year that could impact your business. Two tracts were determined to lose their designation. Tract 705.01 (Hampton West-US 19/41 Corridor) and Tract 701.14 (Stockbridge South-Eagles Landing Pkwy corridor). This will result in a reduction in tax credit benefits available to businesses with plans to locate or expand in this particular area. However, businesses that plan to locate or expand in census tracts 701.14 and 705.01 are eligible to file a Notice of Intent (see link below) on or before March 31, 2020. The NOI is designed to prevent adverse effects to a business based on re-ranking out of a less developed census tract.

If you are thinking or expecting to grow and add new jobs in the next 3 years and your business is currently located in census tract 701.14 or 705.01, we encourage you to complete the Notice of Intent Form. The form is non-binding if you decide not to add positions over the 3 year period. Please submit the form with a copy for your files and send a copy to lbrown@choosehenry.com so we can verify with Georgia DCA. Our team is available to walk you through the process.

Download Notice of Intent Form

BENEFITS AND ELIGIBILITY

Under the Georgia Job Tax Credit (JTC) Program, businesses located in Less Developed Census Tracts (LDCTs) and engaged in manufacturing, warehousing and distribution, processing, telecommunications, tourism, or research and development industries may be eligible for the state’s highest job tax credit benefit level. Eligible Business Enterprises, located in LDCTs that create 5 net new jobs within a single tax year may apply for the tax credit of

$3,500 per eligible net new job created. Businesses may claim the job tax credits for up to five years, as long as the jobs created are maintained.

You can search your company’s address to see if you are located in a Less Developed Census Tract using the link below. Click on the layers for the LDCT to have these layers shown on the map.